In this quarterly report, in addition to the traditional review, we would like to discuss the most important factors for gold and gold miners. Considering the high importance of the relative performance of our fund against S&P 500 and MSCI World Equity Index, we also show the importance of earnings revisions, which should not be underestimated. For a few months now, a very positive change has been taking place, which has not yet been noticed by the majority of investors and is likely to be accentuated in the coming months.

Review

On 30 June 2023, the gold price closed at USD 1,919.35/ounce, down 2.5% q-o-q. The Philadelphia Stock Exchange Gold and Silver Index lost 8.7% (USD) / 9.1% (EUR), while the Nestor Gold Fund (share class –B-) consolidated by 10.1% (USD) / 10.5% (EUR). The fund underperformed in Q2 2023 due to its small and mid caps tilt, which performed worse than the large cap gold producers.

The gold price consolidated in Q2 2023 due to traditional seasonal weakness as well as ETF outflows and COMEX selling. The selling pressure of tactical investors was due to a higher long term yields and pricing in of further FED hikes. Gold mining companies reported their Q1 2023 results, which were generally better than expected. While production was largely in line, costs reported were mostly below expectations, confirming our view of abating cost inflation after two years of relatively large cost increases. Accordingly, we do not expect any more negative surprises during the course of this year and positive surprises are highly likely.

Please find below the most important drivers of gold and gold miners as well as their short- and medium-term outlook:

Physical gold market

Game changer in physical gold, as central banks have started to diversify into gold after freezing of Russian foreign exchange reserves.

Non-NATO countries and states that are not so well-disposed toward the USA starting to diversify away from the USD, EUR and Western foreign currencies into gold, as the only currency independent of political will!

Unlike the very frustrating years 2011-2022, when gold ETF demand was the key driver of up and down legs in gold and gold miners, since Q4 2022, due to significantly more central bank buying (quickly diversifying away from Western currencies), the physical gold price isn’t depending any more in a major way on short term/tactical investor demand. This is the first time since close to 20 years and gold can now rise without investors piling into the gold market! The diversification away from the US dollar and Western currencies

Macro outlook gold

Based on very reliable forward guidance models and sharply increased FED interest rates, the economy will weaken further in the coming quarters. The more restrictive credit policy of U.S. banks is a further burden on the economy. In addition, most of the excess savings from the pandemic have by now been depleted.

However, given there has been no major credit cycle, no strong investment cycle, relatively low interest rate sensitivity from U.S. consumers and U.S companies (they have hedged at low interest rates for the long term) and given the demographic situation in the labor market, there is reason to believe there will be no severe recession. We therefore share the consensus view of low growth or a mild recession for 2023, but expect that environment to be structural (unlike the consensus, who believes in a recovery after the weak economy through 2023).

The decline in inflation is already slowing due to the diminishing influence of the base effect, which is even omitted completely in the second half of the year. The only notable easing is still coming from rental and maintenance costs (shelter), while inflation is already starting to rise again in the first sub-segments!

Generally, the consensus remains far too optimistic for the stock market. The FED funds cuts priced in by financial markets will be delayed and the expected interest rate reductions are likely to be smaller than expected. This suggests a very negative outlook for growth equities but a very bullish one for the winners of a stagflation-like scenario (i.e. gold and commodity equities). Structurally higher inflation is based on the following new long-term trends:

• deglobalization vs. globalization

• structural labor shortage due to demographic development

• start of a structural dissaving cycle due to demographic development

• start of a structural bull market in commodities after more than 10 years of underinvestment

• decarbonization, which needs a lot of infrastructure spending.

To summarize, we consider a soft landing or a mild recession as not very important for the gold market. Regarding the inflation outlook, while we forecast that headline and core inflation will continue to decline during the next few months, we see the decline well below market consensus and, far more important, the structurally higher inflation is not (yet) priced into the financial markets. As a result of that, we expect a rotation in financial markets from long duration assets (due to stubborn inflation, decreasing expectation of FED rate cuts) to winners of a stagflation-like scenario (analog Q1 2022).

However, if we are wrong with our inflation timing and inflation continues to drift significantly lower, then significant FED fund rate cuts are highly likely, which in the past led to significant price gains in gold and gold miners.

Outlook gold miners (micro outlook)

Production cost inflation is abating (cost in Q1 2023 well below consensus expectations) and therefore leading to positive earnings revision (major relevance of that on page x in the report). This leads to renewed interest from heavily underweighted generalists and quant investors. In addition, gold miners are on a record low valuation relative to physical gold, extreme undervaluation against their own history and significantly undervalued vs. the equity market. The juniors, especially exploration and development companies, are also on a record discount to large producers and royalty companies, supporting the extremely low valuation of the Nestor Gold fund further.

Behavioural Finance

The gold market exhibits extreme disinterest and that is even more pronounced for gold miners. Gold ETFs incurred very high redemptions between April 2022 and March 2023 and investor interest, despite the most likely scenarios being stagflation-like or major FED pivot, hasn’t increased recently. High outflows of active and passive gold mining funds during 2023 are also extremely positive and reliable contra indicators. In addition, despite the fact that gold is close to the all-time high, the speculative positioning at COMEX is modest. From a behavioural finance point of view, the current signals are similar to end of 2015/early 2016, late 2018 and October 2022, all perfect and attractive buying opportunities offering investors substantial gains in the following months/quarters! Given the even bigger underweight of investors in gold miners, the signals for gold miners are even more pronounced for the miners vs. physical gold!

Technical Analysis

Gold is near the all-time high and short-term indicators are slightly oversold, a perfect time to add. Given gold reached, within less than three years, three times the USD 2’070 – USD 2’080 level and the fact that technically a “triple top” doesn’t exist as a chart formation, we expect gold to break through this resistance within the next few months and reach substantially higher levels. The physical gold market supply/demand situation, the macro outlook and the signals from Behavioural Finance support that view strongly.

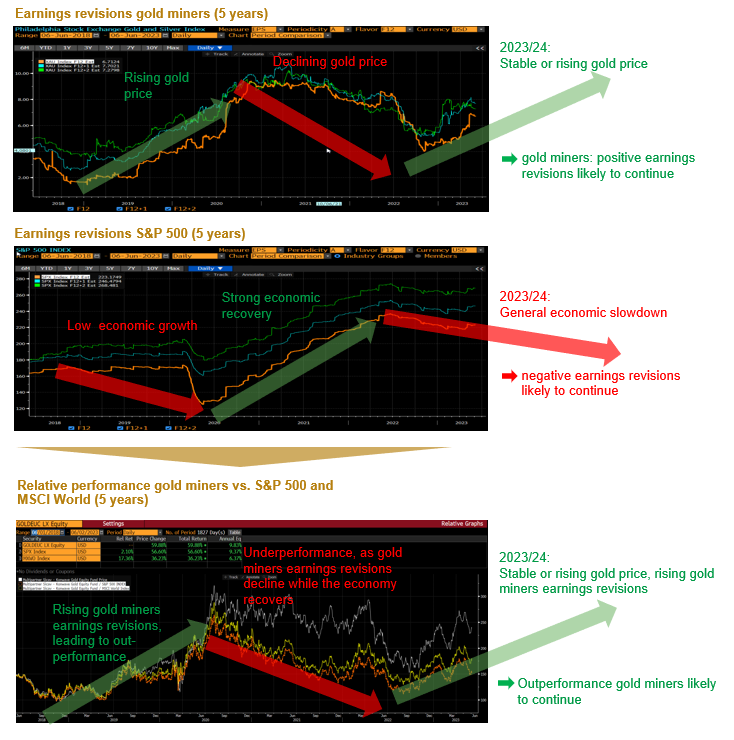

The very strong relationship between earnings revisions and relative performance of gold miners

While the strong correlation between relative earnings revisions between the broad equity market and the gold miners is self-evident and comprehensible, it isn’t always at the front of investors’ minds. As we are at a very similar point in the gold and economic cycle as in late 2018, this sector is receiving further strong support, in addition to the points described above. The following chart underlines the currently very high attractiveness of the gold and gold mining sector.

Source: Bloomberg, Konwave AG

Conclusion

Gold and gold miners languished during Q2 2023 (seasonally often the weakest period of the year). Gold miners surprised with costs below consensus expectations, a trend which could continue during the year and a complete change from 2021/2022, where costs rose more than generally expected. This will in an environment of stable or rising gold prices likely lead to further positive earnings revisions, supporting the performance of gold miners in H2, 2023.

For the first time since more than 20 years, all key factors for gold and gold miners (physical gold market, macro, micro, behavioral finance and technical analysis) are “green” (while we had four out of five lights in green at the bottoms at the end of 2015, end of 2018 and October 2022). As a result, the outlook for the remainder of 2023, as well as for the coming years, is exceptionally positive, while the expected returns of traditional investment portfolios (equities, private equity, bonds and real estate) may be described as challenging at best. With this in mind, and in order to protect the wealth of investors, we recommend taking into account the risk budgets, to shift a portion of the asset allocation into gold, gold mines, commodities and commodity shares. These strongly undervalued asset classes, which are heavily under-represented in institutional portfolios, have from our point of view had by far the highest return potential in the coming years.

We used the weakness during May to position the Nestor Gold Fund accordingly and expect that it will perform particularly well in the continued bull market, which started in October 2022, similar to previous bull market phases. Especially in the period after the initial underperformance of explorer and developers (like during 2021 to Q2 2023), the return in the past was several times higher than the index return. This phase, which is particularly attractive for our investment approach, should start soon and last at least 1 to 2 years.

Walter Wehrli and Erich Meier, Konwave AG